Tuesday, September 26, 2006

Vending Machines

I tried to find pictures of these dry cleaning ATMs on the net but failed. Maybe it's not actually been done yet.

The vending machine industry in Japan is so innovative and huge that they have a "Japan Vending Machine Manufacturers Association" (JVMA). See some vending machine pics here.

Here's a thought. Why don't we start the rage in Singapore? Buy a couple of the weirdest vending machines from Japan and plonk them around town...

Categories: Drycleaning, ATM, vending, machines, japan, jvma

Latest IPO - Energy Stocks

SINGAPORE (Dow Jones)--Chemoil Energy Ltd., a U.S. marine fuel supplier, expects to raise up to US$374 million from an initial public offering in Singapore, according to a prospectus filed Tuesday.

The company is offering about 439.5 million shares at a maximum price of US$0.85 each, according to the prospectus posted on the Monetary Authority of Singapore''s Web site.

The offer comprises 366,240,000 new shares and 73,248,000 existing shares.

So... Anyone interested? I think this will be a good one - if you can afford it. Will post something on the energy sector if I can find the article online.

Categories: Chemoil, Energy, marine, fuel, supplier, offering, ipo

Not enough money? Start an Investment Club!

Here's a Fool.com description of Investment Clubs:

Investment clubs have been around for decades, and tens of thousands exist in America today. They've been growing in popularity in recent years, partly due to the best-selling books by the Beardstown Ladies.

Members of investment clubs, often groups of friends or co-workers, typically meet once a month to discuss companies and make decisions about which stocks to buy and sell. At meetings they each contribute a small sum of money that is deposited in a joint account. Members take turns researching and reporting on promising companies in which they might invest or companies in which the club is already invested.

The

National Association of Investors Corp. (NAIC), established in 1951, has set forth guidelines for running successful investment clubs. It urges members to:Invest money regularly, regardless of market conditions

- Reinvest all dividends and capital gains

- Buy stock in companies that are growing faster than most of their peers

- Diversify investments, not putting all the communal eggs into one basket

These guidelines are fully Foolish and quite sensible. (Of course, hang around Fooldom online and you'll glean much more guidance. We run a bunch of real-money portfolios, modeling a variety of investing strategies for you.)

Investment clubs today hold a total of more than $175 billion worth of equities in their portfolios -- rivaling the largest mutual funds. Each month investment clubs add more than $50 million. This is big business -- and exceedingly Foolish, too.

Categories: investment, club, capital, gains, members, money, mutual, funds

Monday, September 25, 2006

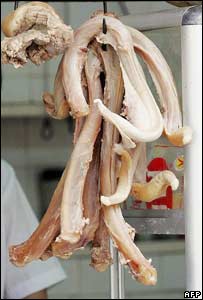

The Penis Restaurant

Someone is lopping off the totem poles of dogs, donkeys and tigers and making a fortune by serving them as gourmet delicacies.

"We are in a cosy restaurant in a dark street in Beijing but my appetite seems to have gone for a stroll outside.Given that "Organ Soup" (broth containing goats' penises) hit Singapore hawker centres years back, I guess I shouldn't be making a big deal out of this. But Organ Soup never sat well with me either.Nancy has brought out a whole selection of delicacies.

They are draped awkwardly across a huge platter, with a crocodile carved out of a carrot as the centrepiece.

Nestling beside the dog's penis are its clammy testicles, and beside that a giant salami-shaped object.

"Donkey," says Nancy. "Good for the skin..."

She guides me round the penis platter."

It must be that at some primal level I find something objectionable about chewing on some other creature's manhood / beasthood. Afterall, I have no bone to pick with eating a chicken's rear leg...

Anyway, read more here if you have the stomach for it.

Some quotable quotes:

"It is cold and bland and rubbery."

"Not long ago, a particularly rich real estate mogul came in with four friends. All men. Women don't come here so often, and they shouldn't eat testicles,"

"What better way to secure a contract than over a steaming penis fondue."

Categories: Penis, Restaurant, dogs, donkeys, tigers, fortune, gourmet, delicacies, beijing, appetite, tesicles, organ, soup

Friday, September 22, 2006

Own a Sports Team

Excerpts:

"I was always a sports nut," says Stickney, who played hooky from school to watch the Indians win the 1948 World Series. "I never realized that the business side of it was just as interesting."

He made his first foray into the minors in 1986. He had just sold his medical specialty company and joined a group of investors led by actor Mark Harmon, paying $90,000 for a 30% stake in a team that became the San Bernadino Spirit.

Four years later the Spirit had become a farm team for Seattle and saw its first star, Ken Griffey Jr., pass through on his way to the Show.

But it was still bleeding money. Stickney had his own ideas about how to turn a profit, so in 1990 he spent roughly $500,000 to raise his stake to 60% and named himself GM.

First he ditched San Bernandino (the Spirit played on an ex-Little League field) and struck a deal with the city of Rancho Cucamonga, which was building an $11.5 million ballpark, one of the first in a wave of major league-grade, single-A stadiums.

He also had a revelation. "It's very simple: You can't depend on the baseball to sell your tickets," he says. He nixed ticket giveaways and instead began to draw fans with carnival rides, half-inning skits, promotions, and fireworks. Tremor the mascot was hatched out of an egg at the first game.

Stickney's timing was perfect. The 1994 strike drove disgruntled fans to the farm teams, pushing minor league attendance from 33 million in 1994 to 41 million in 2005. With an average of 3,950 fans per game last year, the Quakes have topped California League attendance every season for the past decade.

Meanwhile, Stickney teamed up with his son Ken and several other investors to found Mandalay Sports, which bought five other minor league franchises across the country. The teams - notably the Dayton Dragons and Texas's Frisco RoughRiders - have thrived following the lessons Stickney learned at the Epicenter.

One caveat for aspiring owners: In the minors, all on-field talent are provided and managed by the major league parent club, a lack of control that can be tough (the Quakes are now affiliated with the Angels). On the upside, the majors pick up salaries, workers' comp, and health insurance bills.

Minor league baseball teams are "great properties to have," says sports investment banker John Moag of Moag & Co. "They're almost like utilities: Most provide an annual dividend, they're established, they're fairly conservative, and they appraise well in value."

Last year, Stickney says, 40% of the Quakes' $3 million in revenue came from ticket sales, 40% from advertising, and 20% from sales at the park. Profit margins hover between 5% and 10%, and the team Stickney and his partners bought 20 years ago for $250,000 would sell for upwards of $7 million today.

"If you're looking for a quick buck, this isn't it," laughs Stickney. But, as Yankee slugger Phil Linz once said of baseball, it sure beats working for a living.

Categories: Abramovich, Glazer, baseball, sports, team, own, world, series, franchise, Yankee, slugger, Phil, Linz

Last Laughs

Today I read that Google isn't all that prime. See Google gets a new ad-versary by Erick Schonfeld and Jeanette Borzo, Business 2.0:

... It's not often that you find a startup CEO openly mocking Google (Charts). But Gurbaksh Chahal, founder of BlueLithium, thinks Google is a one-trick pony when it comes to Web ads. "They've miserably failed in the last year with display ads," he notes, "because they look at the world through text advertising." It's big talk -- and you'd be tempted to dismiss Chahal entirely were it not for his claim that BlueLithium has been profitable since its third month of operation and is on track to hit $100 million in revenue by the end of next year...

Categories: google, yahoo, latecomer, incumbent, startup, BlueLithium, overtake, first, newcomer

Sounds Right

Amar Bose: Bose

From the Sep. 2004 Issue of FSB

By Brian Dumaine

Bose is known for high-end audio equipment and dedication to research. Founder Amar Bose, who still owns most of the $1.7 billion company, reinvests all its earnings into R&D. That approach has created cultlike fans and innovative products—its wildly successful Wave radio took 14 years to create. Now Bose has a new product that could shake up the car industry. (Hint: It's not stereo equipment.)

When I was 12 years old, in 1943, I bought a radio kit, and in building it I learned how to read schematic diagrams and repair radios. My father, an immigrant from

In 1956, when I was at MIT finishing my doctorate, I bought my first hi-fi system based on the best specifications. I brought it home and played some violin records, and I couldn't believe it. The sound wasn't right (I had played violin growing up), but it should have been right based on everything I had been taught about engineering. So either the manufacturer was cheating on the specs, or the specs were not meaningful. It turned out it was both, by the way. So I started working in the MIT acoustics lab to find a solution.

My first product didn't come out until 1965. It was a speaker in the shape of an eighth of a sphere, which fit in a corner and reflected sound all around the room instead of in a direct beam as with conventional speakers. I was a professor and didn't know anything about business. I projected we'd sell $1 million worth of speakers our first year. We ended up making 60 units and sold 40. That sphere-shaped speaker eventually evolved into our 901 system, which we launched in 1968 and which was the product that really built the company. It was much different from anything that existed—I was able to patent it—but it was a hard sell at first. The 901 had no woofers and no tweeters, which every speaker was supposed to have. It was very small compared with the steamer trunk-sized things that were on the market at the time. When you hear live music, very little of it comes to you directly; most of it bounces off walls and ceilings first. A traditional speaker just blasts the sound directly at you. Like a live performance, the 901 blended both direct and reflected sound.

When we first launched the 901, it was a total disaster. None of the retailers had any idea how to demonstrate the product. One dealer in

When I got back to Bose, I created a seven-minute audio demonstration to help dealers explain to customers how the 901 worked, and that really helped spur sales. [Editor's note: Bose doesn't release any figures, but the NPD Group, a market information firm in

The biggest crisis I ever faced at Bose hit in the early 1980s, when interest rates rose to 22% or so. Technology companies everywhere were going down, and banks were panicked, putting all sorts of restrictions on their loans. We were in the thick of developing our new car audio system for GM. The situation was pretty scary because it could have forced us to go public to raise capital, something I vowed I would never do. Going public for me would have been the equivalent of losing the company. My real interest is research—that's the excitement—and I wouldn't have been able to do long-term projects with Wall Street breathing down my neck.

How did we hang on? I told GM how our bank—it had given us a $14 million loan—was trying to constrain us. A couple of weeks later I got a call from Ed Czapor, who was head of GM's Delco Electronics. He asked me to fly out to

Around the same time, GM delivered $700,000 worth of production equipment to our factory in

Our latest product is a new car suspension system, which has been in development for nearly a quarter of a century. I first got interested in suspensions as a young man. In

At this time people were looking to hydraulics for solutions, but they weren't getting anywhere. So we decided to start from scratch and throw out the old system entirely. After five years of working out some complex mathematical algorithms, we found we could get huge improvements on paper, but we didn't know what the hardware would be. What we ended up with is an electromagnetic motor installed at each wheel. When power is applied, the motor retracts and extends. One of the key advantages of an electromagnetic system is speed. The motor responds to conditions in the road quickly enough to counter the effects of bumps and potholes, maintaining a comfortable ride. The motor is also strong enough to put out enough force to prevent the car from rolling and pitching during an aggressive maneuver.

We've worked on this system and tested it for 24 years now, and are finally ready to show it to the auto companies. It will probably take several years before they adopt it; they'll want to do some of their own testing, but we've designed it so that it can bolt right onto the chassis of current production cars—they won't have to do expensive retooling to make this technology work. We'll probably first see it as an option in luxury cars—we don't know exactly how much it will cost, but as the suspension gets more widely adopted, the price will come down, and we'll probably see it in all but the most inexpensive cars, which is how ABS brakes developed. Oh, and the potential size of the market? We really have no idea. We just know that we have a technology that's so different and so much better that many people will want it.

Categories: amar, bose, beginning, startup, business, story, audio, equipment, engineering, research, design, immigrant, speaker, repair, crisis, capital, gm, hydropneumatic, suspension, system, technology

Maglite

Maglica's life story would make a great movie. He was born in

In the 1950s I got a job at a machine shop in

I knew someone in the 1970s named Don Keller, who later came to work for me, and still does. He had been a policeman, and he knew cops who had problems with their flashlights. The flashlights were flimsy, made of plastic, and if you dropped them, they would break. Keller said that if someone could make these out of metal, they wouldn't break.

He and his friend tried making one out of the metal shaft of a fence post. They packed it with rags and the guts of a regular flashlight. Then they took the design to a tool-and-die shop, but those places don't do high-production. They do ten, 20, 50 pieces at a time. So the flashlights were too expensive. They farmed the work out to me, because I could do higher production, but I couldn't get them to pay me. I also made flashlight parts for another company, but that had problems too. The second company gave me a purchase order for 10,000 lights, so I tooled up, invested all this money, and started making them. They said, stop, slow down, you're making too many. We can't sell these flashlights. They wanted me to make them but only give them to them as they needed, which didn't work for me. I almost got into a lawsuit with them to get them to pay me, but they finally did.

By then I had all this equipment in place. And I thought that I could make a better flashlight than they were making. Better quality. I designed one with a pushbutton switch instead of a slide switch, and an adjustable beam, so you could go from flood to spotlight. And contacts inside that are self-cleaning—when you push the button, the contact revolves and scrubs against the other part. It takes the oxidation off the metal, so you get a better connection. We get letters from customers all the time, with stories about the lights and what they've been through. Like someone losing a light in a lake and finding it the next year, and it still worked.

Since 1979, when we took the first Maglite product on the market, we have never raised our prices. We've increased the quality, but maintained the same price. People say, how do you do it? Maybe you charged too much money to start with. That's not the case. It's the automation and innovations we've created along the way. We've actually added value to the product. We now include batteries and replacement bulbs, things like that.

There are still so many challenges though. It can be hard to compete in this country. First I have to design a product that's better than anything else that's out there. Then I have to find the most efficient way to manufacture it. Then there's protecting your patents, once you actually get them. One patent we applied for took 14 years to get approved. Fourteen years! Ninety percent of the people in this factory don't know what new product I'm working on now. I've spent more than $70 million in litigation to defend my intellectual property rights. Can you imagine what I could have done with that $70 million? More employees, better products, a bigger company. You can't try a patent case in this country for less than $1 million.

I think we've filed more than 200 lawsuits worldwide over the years. Most of the times we settle, and we've never lost a case, but still we have litigation going on all the time. It's pretty easy to find out about products that infringe on our intellectual property. The public often helps us find out. Someone in our warranty department will get an angry letter and a returned product, and it turns out that the flashlight isn't even ours. It's a copycat. Or we see people at the trade shows. I once saw someone with a knockoff at a show, and I explained to him that I spend a lot of money on R&D. He told me, "I spend a lot too. My R&D is my attorney." I sued him and ultimately settled, but it took three years and cost me about $5 million.

We also have sales reps who go to the stores. Infringers aren't shy, and they advertise their products right next to ours. We had one situation where a company in

I figure I'm going to have litigation forever. It's not going to stop. But I hope people are smart enough to know that I'm not going to give up, that I'm not going to let them come and take something from me.

Categories: business, startup, story, beginning, maglite, maglica, mag, instrument, new, york, flashlight

Boston Beer Co.

I love an icy Sam Adams....

I love an icy Sam Adams....Here's how it all began.

For five generations, the men in the Koch family became brewmasters. Koch began his career as a consultant, but in 1984 he founded Boston Beer Co., maker of Samuel Adams. It's now the sixth-largest

I'll never forget my first sale. I'd never sold anything before. I'd always had this status and prestige of three Harvard degrees and my high-paid consulting job. This meant removing all those buffers and becoming a beer salesman. It was scary. There was no growth in the beer industry, and continuing brutal consolidation. The competitors were 100 times any size I could ever contemplate being. I had told my dad I wanted to leave my job and continue this 150-year-old family tradition, and I'd thought we were going to have a warm father-son moment. He just looked at me and said, "You've done some dumb things in your life, but this is just about the dumbest." In 1948, when he got out of brewmaster school, there were about 1,000 breweries in the

But as I explained it to him, he began to understand I wasn't trying to compete with the big American brewers that had driven all these little breweries out of business. My company didn't need to be that big for me to be happy. So we went up to the attic and got out my great-grandfather's recipe, Louis Koch Lager, and he said, "This is really good beer." I took the recipe home and made it in my kitchen as best I could. When it was finished aging and I tasted it, I knew I had something.

To sell it, I went to all five of the distributors in

The day I started selling, I walked to the first bar I saw, a place called the Dock Side. I started talking to the guy behind the bar. He was just nodding, no matter what I said. It turned out that he spoke only Spanish and didn't understand anything I was saying. Luckily the manager saw me, rescued his bar back, and listened to my story. After he tasted my beer, he said, "Kid, I like your idea, but I didn't think the beer would be this good. I'll take it." I was so excited, I forgot to ask for the order. I had to go back the next day and say, "How many cases would that be?"

Categories: Samuel, Adams, Boston, Beer, Jim, Koch, beginning, business, startup, story

Thursday, September 21, 2006

Why The Rich Go Broke

Mark Twain, who had a lifelong penchant for dodgy investments and gimmicky inventions, lost about $4 million in today's dollars betting on a newfangled but unwanted typesetting machine in the 1890's. He subsequently had to take to the lecture circuit to stave off bankruptcy.Michael Jackson, who began churning out Top 10 songs and albums as the lead singer of the Jackson 5 before reaching puberty, found it necessary to pledge a stake in his lucrative songbook of Beatles hits to secure a $270 million bank loan to forestall a slide into bankruptcy.Mike Tyson, like Jackson a gifted man-child, is entangled in his own financial woes despite once having the marquee power to draw $30 million purses for a single fight. When Tyson filed for bankruptcy in 2004, he listed debts of $27 million, including about $13 million in unpaid federal taxes and about $174,000 for a diamond-studded gold chain. He had maintained a monthly budget of about $400,000 before the filing.Buffalo Bill, Michael Jackson, Mike Tyson, Wayne Newton, Burt Reynolds, Elton John and other public examples of spending run amok were, or are, all entertainers, and entertainers offer ready fodder for tsk-tsking - largely because gossip columns make it easy for the rest of us homely paupers to take quiet satisfaction in their plight. Entertainers, for the most part, are also peculiarly vulnerable when it comes to personal finance."You have people who are struggling for a long time and then overnight, boom, they hit it," says Shelley Finkel, Mike Tyson's manager. "If they don't have someone watching out for them, and some emotional stability, it will be very hard for them to be grounded financially."..."The rich are different from you and me: they are more egotistical," says Theodore R. Aronson, managing principal of Aronson Johnson Ortiz, an investment firm in Philadelphia. "Psychologically, I think the rich, because of their egos, think they know everything. Well, they don't, and many of them repeatedly make horrible investments - because they can."Financial success can breed its own peculiar set of vulnerabilities. "People who are very successful develop elevated sensibilities about their skills, and when things turn on them they won't admit they're wrong because their self-confidence has held them up so long," says Arnold S. Wood, chief executive of Martingale Asset Management in Boston. "In the face of evidence, even subjective evidence, that suggests that something bad is about to happen to someone, a funny thing happens: They reject the evidence."These kinds of people just continue spending because they think the money will keep coming in because they're so successful," adds Wood, who says he is fascinated by the possible neurological and social underpinnings of financial delusion and decision-making. He believes that gender plays a strong role in financial ruin because, he says, women tend to be more risk averse than men when it comes to money. Some interesting research backs this up....America's consumer landscape, which prizes spending and encourages people to define themselves by what they own, only makes the financial balancing act trickier for adults, especially if they have fat wallets."Someone who goes broke, or someone who goes into debt, is really somebody who isn't comfortable having their money," Gurney says. "Yes, it appears as a lack of discipline. But the lack of discipline comes from an emotional place that causes them to be undisciplined. It's not about the money. It's about our emotional relationship to money. "The people who are out there just running through money have failed because they haven't come to terms with who they are and what they want the money to do for them," she adds. "I see a lot of baby boomers beginning to panic because they haven't figured this out."

Categories: rich, broke, financial, success, ego, investments, vulnerabilities, discipline, consumerism

Wednesday, September 20, 2006

Selling the moon

This dude wrote a book about selling the moon.

Read an excerpt from this book here.

Needless to say, interesting legal issues of ownership and selling something you don't own arises. From wikipedia:

QUOTE

In these early stages of speculation about ownership of extra-terrestrial real estate, the legal issues are still extremely vague. One of the underlying issues is whether private ownership of such property is recognised or not. It is generally accepted that, as stated by the United Nations "Outer Space Treaty", space is the "domain of all mankind", and can no longer be claimed by any governments. It omits mentioning private individuals.

Legal experts agree that private ownership of the Moon is not explicitly forbidden in the Outer Space Treaty of 1967 which states that only governments are not allowed to own lunar or celestial property. The Outer Space Treaty has been ratified by 157 countries as well as all space faring nations.

Because private ownership was not included in the Outer Space Treaty, a new treaty, the Moon Treaty of 1982 attempted to explicitly fix this omission by forbidding private ownership of the Moon and the celestial bodies. However the Moon Treaty has not been signed after 3 attempts in the UN, nor has it been signed or ratified by the United States or any other major or space faring nation for fear that private exploitation of the Moon and its resources would be hampered by the treaty.

The legal issues partly depend on which is being discussed:

- Land ownership on planets and moons

- Ownership of vacant space

Aware of the need for a stricter approach, the Board of Directors of the International Institute of Space Law (the learned society of space lawyers) issued a Statement in 2004 where it deplored the augmentation in the extraterrestrial real estate business “raising the opportunity for individuals to be misled”.

The statement reads, inter alia – “The prohibition of national appropriation [of outer space and celestial bodies] … precludes the application of any national legislation on a territorial basis to validate a ‘private claim’. Hence, it is not sufficient for sellers of lunar deeds to point to national law, or the silence of national authorities, to justify their ostensible claims. The sellers of such deeds are unable to acquire legal title to their claims. Accordingly, the deeds they sell have no legal value or significance, and convey no recognized rights whatsoever.”

The Board of Directors of the IISL calls State Parties to the Outer Space Treaty to – “comply with their obligations under … the Outer Space Treaty …[being] under a duty to ensure that, in their legal systems, transactions regarding claims to property rights to the Moon and other celestial bodies or parts thereof, have no legal significance or recognised legal effect.”

While space lawyers consider the purported sale of extraterrestrial real estate a trivial matter, pertaining to consumer protection law, most of them agree that the subject of real property rights in outer space needs to be clarified. Among the specialists in the field of extraterrestrial property rights are Wayne J. White Jr., Virgiliu Pop, Alan Wasser and Alexander Soucek of ESA.

UNQUOTEHere's what Virgiliu Pop has to say:

QUOTE

Land on the Moon for sale? Think twice!

For eons, the Moon has been the symbol of supreme desire. Asking for the Moon meant asking for the impossible. Owning the Moon and the stars was both the ultimate want and the ultimate folly. And, proven that a fool and his money are easily parted, there ought to arise people who would readily exploit this weakness. With or without material aims, many people throughout the ages thought they were the first ones to embed the flag of their desire on the alien orbs. As the Moon waxes and wanes above them and their unreal estate businesses, this book chronicles their way from anonymity to fame and back again.

"[Unreal Estate] is both a welcome documentation of the latest step in humankind's long history of land schemes and an entertaining look at our place in space. ... I look forward to first conviction for fraud on Mars -- then we will know humankind is truly expanding into the solar system. " - Louis Friedman, Founder and Executive Director, The Planetary Society.

"Virgiliu has done stellar research on this topic and his book is extremely informative and interesting. You will find the stories he tells to be compelling, the legal arguments as to why one cannot own space real estate to be illuminating, and the entire book to be not only unique but very special." - Dr. David M. Livingston, Founder and Host of The Space Show .

"Who could be cooler than a space lawyer named Pop? ... If Virgil's fascinating stories and characters from the annals of space property claims were the issues, I might never have fallen asleep during property class in law school ... Pour yourself a chilled snake oil cocktail and dig in." - Jesse Londin, Space Law Probe.

UNQUOTE

Categories: selling, moon, real, estate, Outer, Space, Treaty, Land, ownership, planets, Virgiliu, mcardle

Liquid Gold

(article) contributed by Calvin.

Thanks!

Categories: illegal, urine, sales

Don't Panic

Case in point is this morning's coup in Thailand. As expected, after hearing news of the coup, upon (Singapore) market opening, there was general bloodshed... Traders were selling across the board, STI traded 25 points lower... It was ugly.

So, just like any panic-stricken trader, I sold my shares in AsiaPharm, and took a loss of $150 in my stride. All things considered, not a bad loss (or so I thought). It's now 11.45, less than 3 hours after market open. The stock I sold is now up by one tick, was up by 2 ticks at one point, ie. the person who bought the shares from me has made a $100 profit in less than 3 hours.

Here's a thought. If the stock market operates on a willing buyer - willing seller basis, who is buying when everyone else is selling??

Categories: Bad, News, Buying, Opportunities, coup, Thailand, STI, AsiaPharm, stock, market,

Tuesday, September 19, 2006

Sell Missiles

Categories: missiles, arms, indonesian, chinese, shrimp, army, war, wealthy

one red paper clip

The Million Dollar Homepage

Selling pixels. Who'd have thought of that.

Excerpt from BBC:

http://news.bbc.co.uk/1/hi/magazine/4585026.stm

- QUOTE -

By Tom Geoghegan BBC News Magazine |

It took a 21-year-old a few minutes to come up with an idea which has made him more than one million dollars in four months. So what's his secret?

It started with a blank notepad, an overdraft and a shortage of socks.

Now it's a million-dollar business.

Last August, as a three-year degree loomed, Alex Tew lay on his bed in his family home in Cricklade, Wiltshire. It was time for his nightly brainstorming session.

This time, the problem was his finances. He already had an overdraft, which was sure to multiply at university, and he felt his poverty was reflected by his lack of decent, or matching, socks.

The first thing he wrote in his pad was "How can I become a millionaire?" Twenty minutes later, the Million Dollar Homepage idea was born.

It was selling pixels, the dots which make up a computer screen, as advertising space, costing a dollar per dot. The minimum purchase was $100 for a 10x10 pixel square to hold the buyer's logo or design. Clicking on that space takes readers to the buyer's website.

With $999,000 banked so far, Alex recalls his thought process at the time. He says: "I wrote the title to spark the creativity and then wrote down the attributes the idea needed. It had to be simple to set up and understand.

"It had to have a name to capture the imagination and be something that could be set up quickly with no physical delivery required.

"I wrote down some keywords and then the idea came out 20 minutes later - selling pixels. So I snapped up the domain name that very night."

Snowballing

Alex spent £50 on buying the domain name (milliondollarhomepage.com) and a basic web-hosting package. He designed the site himself but it began as a blank page. His friends and family paid the first $1,000 dollars, which he spent on a press release. That small publicity gave his site more traffic, which in turn persuaded more advertisers to have faith.

"It snowballed," he says. "As I made money, more people talked about it and the more people talked about it, the more money I made."

Four months and 2,000 customers later, including The Times and Orange, and the million dollars is almost surpassed. Two million different people have accessed the site, which has a wry blog and FAQs, in the last seven days.

"I've been blown away. These have been the most exciting and hectic months of my life. Things are quite surreal at the moment and because it's been so busy it hasn't really sunk in.

"It seems like Monopoly money. Previously I'd associated money with working at Tesco getting paid £5 an hour."

His first business venture was when, aged eight, he drew comics and sold them at school. He had no intention of going to university because he wanted to try out some of his ideas.

- UNQUOTE -Categories: million, dollar, homepage, business, college, student, pixels

this is where it begins

If YOU have a crazy idea, don't toss it away. Leave it here!